Homebuyers in These U.S. Cities Get the Best Mortgage Rates

Note: This is the most recent release of our Homebuyers in These U.S. Cities Get the Best Mortgage Rates study. To see data from prior years, please visit the Full Results section below.

As the cost of homeownership continues to grow out of reach for many Americans, mortgage interest rates have become a central concern for both homebuyers and policymakers. The Federal Reserve’s ongoing effort to curb inflation is keeping interest rates elevated for longer than many analysts expected, making home loans persistently expensive. These high interest rates have somewhat cooled the housing market but have not been sufficient to balance the rise in borrowing costs. As a result, many prospective buyers face the daunting combination of steep home prices and expensive financing.

Trends in Mortgage Rates

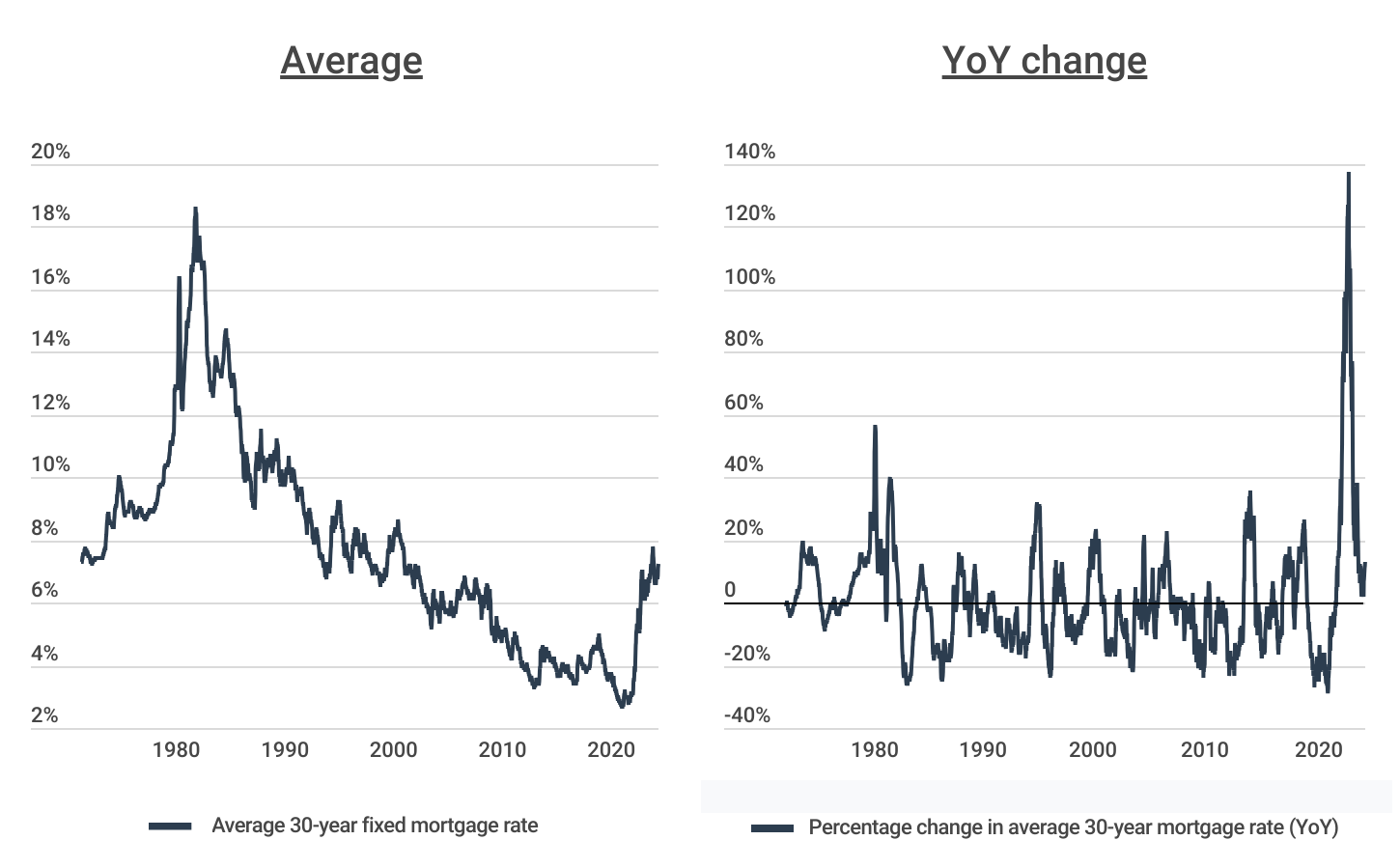

Mortgage interest rates have plateaued after rising at their fastest pace in more than 50 years

After climbing to a staggering 18.63% in the early 1980s, the average 30-year fixed mortgage interest rate steadily declined until reaching a historic low of 2.65% in early 2021. However, since then, rates have risen considerably, reaching 7.79% in October 2023 and sitting at 7.22% in May 2024.

But perhaps most remarkable is the speed at which mortgage rates have risen. Even faster than in the early 80’s when rates climbed at over 50% year-over-year, rates shot up at an unprecedented 138% in November 2022 in response to pandemic-era inflation. This has had a major impact on housing costs, with an estimated monthly mortgage payment for the median-priced U.S. home being over 50% higher today than it was just two years ago.

FOR HOMEBUYERS

When moving or having work done on a house, it’s important to make sure your contractors have adequate insurance. For example, moving companies should have commercial truck insurance, general contractors should have a builders risk insurance policy, and architects should have errors and omissions coverage. These policies will protect the contractor and the homeowner should something go wrong with the work.

Mortgage Rate Characteristics by Location

Homebuyers in North Dakota and Alaska landed the best mortgage rates in 2023

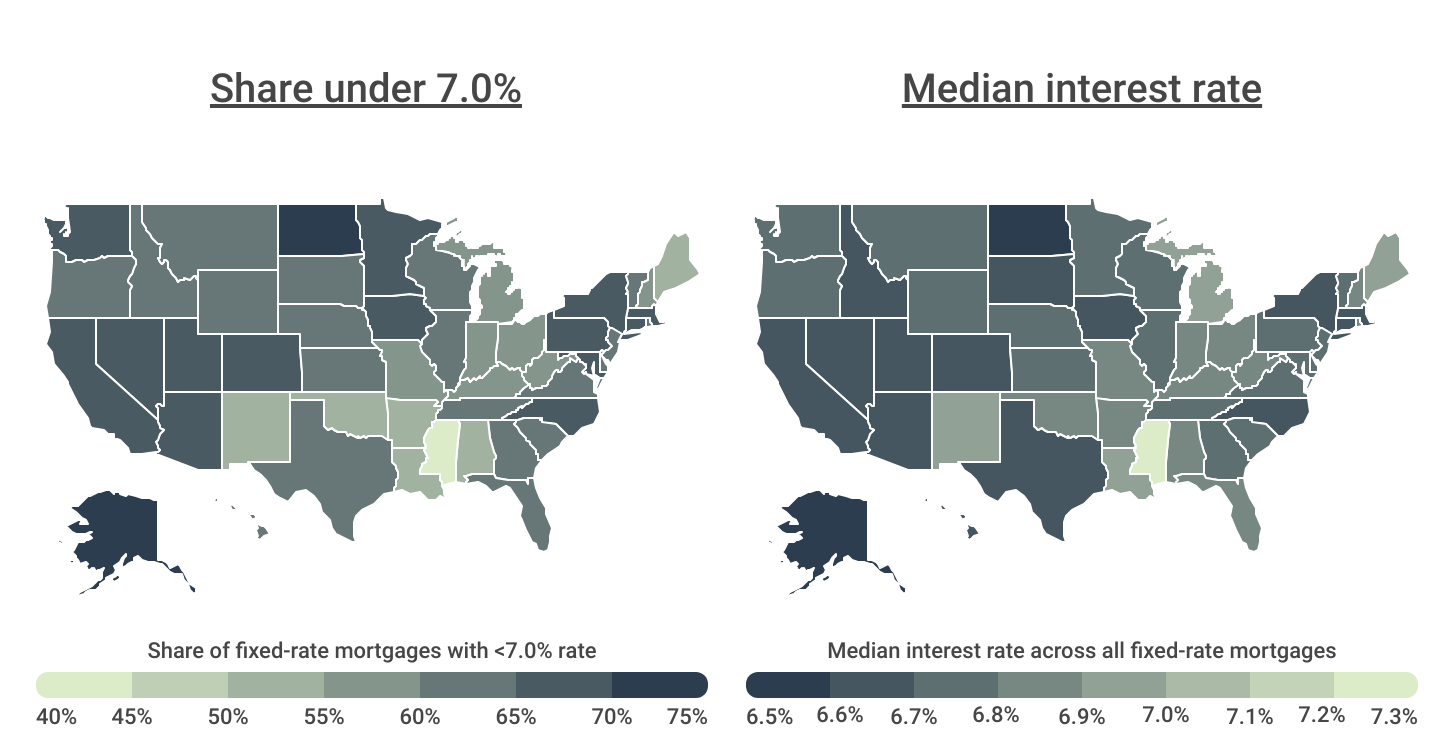

Interest rates vary geographically due to local market conditions, the financial health of residents, and laws governing lenders. Across the U.S., 62.8% of all approved home purchase loans had interest rates below 7% in 2023. However, an even larger share of homebuyers in some parts of the country were able to secure mortgage rates below this figure. At the state level, North Dakota and Alaska had the largest share of fixed-rate mortgages with rates below 7% in 2023, at 73.0% and 72.3% respectively. In comparison, fewer buyers in the South received favorable rates. Just 42.6% of approved mortgages in Mississippi had rates of less than 7%—the lowest level in the country.

Below is a breakdown of the home mortgage rate landscape for over 380 metropolitan areas and all 50 states. Researchers at Construction Coverage analyzed the latest data from the 2023 Home Mortgage Disclosure Act. For more detailed information on data sources and calculations, see the methodology section.

Large Metros With the Best Mortgage Rates

| Top Metros | Share* |

|---|---|

| 1. Austin-Round Rock-Georgetown, TX | 73.3% |

| 2. Denver-Aurora-Lakewood, CO | 71.6% |

| 3. Raleigh-Cary, NC | 71.6% |

| 4. Washington-Arlington-Alexandria, DC-VA-MD-WV | 71.5% |

| 5. Boston-Cambridge-Newton, MA-NH | 71.0% |

| 6. Pittsburgh, PA | 70.8% |

| 7. San Francisco-Oakland-Berkeley, CA | 70.4% |

| 8. Sacramento-Roseville-Folsom, CA | 69.9% |

| 9. Hartford-East Hartford-Middletown, CT | 69.7% |

| 10. New York-Newark-Jersey City, NY-NJ-PA | 69.5% |

| 11. San Jose-Sunnyvale-Santa Clara, CA | 69.1% |

| 12. San Antonio-New Braunfels, TX | 68.9% |

| 13. Nashville-Davidson–Murfreesboro–Franklin, TN | 68.9% |

| 14. Dallas-Fort Worth-Arlington, TX | 68.8% |

| 15. Charlotte-Concord-Gastonia, NC-SC | 68.8% |

| Bottom Metros | Share* |

|---|---|

| 1. Grand Rapids-Kentwood, MI | 53.6% |

| 2. St. Louis, MO-IL | 55.8% |

| 3. Virginia Beach-Norfolk-Newport News, VA-NC | 57.1% |

| 4. Tulsa, OK | 57.6% |

| 5. Miami-Fort Lauderdale-Pompano Beach, FL | 57.6% |

| 6. Oklahoma City, OK | 57.7% |

| 7. Birmingham-Hoover, AL | 58.1% |

| 8. Detroit-Warren-Dearborn, MI | 58.6% |

| 9. Milwaukee-Waukesha, WI | 60.8% |

| 10. Memphis, TN-MS-AR | 60.8% |

| 11. Rochester, NY | 61.1% |

| 12. Cleveland-Elyria, OH | 61.5% |

| 13. Orlando-Kissimmee-Sanford, FL | 61.7% |

| 14. Indianapolis-Carmel-Anderson, IN | 62.1% |

| 15. Columbus, OH | 62.6% |

FOR CONSTRUCTION PROFESSIONALS

Did you know that personal auto insurance often won’t cover you when using your vehicle for work? If you use your personal car for work, it’s important to have a commercial policy. Our guide on the best commercial vehicle insurance explains everything you need to know.

Midsize Metros With the Best Mortgage Rates

| Top Metros | Share* |

|---|---|

| 1. Anchorage, AK | 73.6% |

| 2. Durham-Chapel Hill, NC | 72.2% |

| 3. Madison, WI | 71.8% |

| 4. Des Moines-West Des Moines, IA | 71.6% |

| 5. Provo-Orem, UT | 70.6% |

| 6. Fort Collins, CO | 70.0% |

| 7. Huntsville, AL | 69.9% |

| 8. Colorado Springs, CO | 69.8% |

| 9. Stockton, CA | 69.3% |

| 10. Urban Honolulu, HI | 69.1% |

| 11. Vallejo, CA | 69.0% |

| 12. Springfield, MA | 69.0% |

| 13. Davenport-Moline-Rock Island, IA-IL | 68.7% |

| 14. Reno, NV | 68.6% |

| 15. Greeley, CO | 67.8% |

| Bottom Metros | Share* |

|---|---|

| 1. Montgomery, AL | 48.7% |

| 2. Beaumont-Port Arthur, TX | 48.9% |

| 3. Jackson, MS | 49.0% |

| 4. Shreveport-Bossier City, LA | 49.5% |

| 5. McAllen-Edinburg-Mission, TX | 49.6% |

| 6. Flint, MI | 51.0% |

| 7. Gulfport-Biloxi, MS | 52.0% |

| 8. Fort Wayne, IN | 52.0% |

| 9. Mobile, AL | 52.6% |

| 10. Toledo, OH | 53.2% |

| 11. El Paso, TX | 53.7% |

| 12. Brownsville-Harlingen, TX | 53.8% |

| 13. Lafayette, LA | 54.8% |

| 14. Scranton–Wilkes-Barre, PA | 55.0% |

| 15. Huntington-Ashland, WV-KY-OH | 55.1% |

Small Metros With the Best Mortgage Rates

| Top Metros | Share* |

|---|---|

| 1. Fargo, ND-MN | 76.0% |

| 2. Bismarck, ND | 75.9% |

| 3. Iowa City, IA | 73.7% |

| 4. Cumberland, MD-WV | 72.9% |

| 5. Yuba City, CA | 72.7% |

| 6. Ithaca, NY | 72.7% |

| 7. El Centro, CA | 70.8% |

| 8. Cedar Rapids, IA | 70.1% |

| 9. Sioux Falls, SD | 70.0% |

| 10. Boulder, CO | 69.9% |

| 11. Merced, CA | 69.8% |

| 12. Elmira, NY | 69.8% |

| 13. Fairbanks, AK | 69.7% |

| 14. Ames, IA | 69.6% |

| 15. Rochester, MN | 69.4% |

| Bottom Metros | Share* |

|---|---|

| 1. Farmington, NM | 36.4% |

| 2. Odessa, TX | 36.5% |

| 3. Monroe, LA | 38.7% |

| 4. Texarkana, TX-AR | 38.8% |

| 5. Pine Bluff, AR | 39.6% |

| 6. Longview, TX | 40.6% |

| 7. Hammond, LA | 43.0% |

| 8. Elkhart-Goshen, IN | 43.2% |

| 9. Hattiesburg, MS | 43.3% |

| 10. Kokomo, IN | 44.3% |

| 11. Danville, IL | 44.5% |

| 12. Michigan City-La Porte, IN | 45.3% |

| 13. Victoria, TX | 45.7% |

| 14. Alexandria, LA | 45.8% |

| 15. Wichita Falls, TX | 46.1% |

RELATED

States With the Best Mortgage Rates

| Top States | Share* |

|---|---|

| 1. North Dakota | 73.0% |

| 2. Alaska | 72.3% |

| 3. Massachusetts | 69.8% |

| 4. Colorado | 68.8% |

| 5. Iowa | 68.1% |

| 6. Connecticut | 68.0% |

| 7. New York | 67.7% |

| 8. Nevada | 66.5% |

| 9. Maryland | 65.9% |

| 10. Washington | 65.6% |

| 11. Pennsylvania | 65.6% |

| 12. Arizona | 65.5% |

| 13. California | 65.2% |

| 14. Minnesota | 65.1% |

| 15. Utah | 65.0% |

| Bottom States | Share* |

|---|---|

| 1. Mississippi | 42.6% |

| 2. New Mexico | 50.3% |

| 3. Louisiana | 53.0% |

| 4. Maine | 53.1% |

| 5. Oklahoma | 54.0% |

| 6. Alabama | 54.5% |

| 7. Arkansas | 54.9% |

| 8. Michigan | 55.8% |

| 9. Indiana | 56.1% |

| 10. New Hampshire | 57.3% |

| 11. Missouri | 57.5% |

| 12. Kentucky | 58.6% |

| 13. West Virginia | 58.7% |

| 14. Ohio | 59.8% |

| 15. South Carolina | 60.9% |

*Share of fixed-rate mortgages with <7.0% rate

Methodology

To determine the locations where homebuyers get the best mortgage interest rates, researchers at Construction Coverage analyzed the latest data from the Federal Financial Institutions Examination Council’s 2023 Home Mortgage Disclosure Act. The researchers ranked metros according to the share of all fixed-rate mortgages with less than a 7% interest rate. Only conventional home purchase loans approved in 2023 were included in the analysis. In the event of a tie, the metro with the greater share of 30-year mortgages with less than a 7% interest rate was ranked higher. Researchers also calculated the share of 15-year mortgages with less than a 7% rate, and the median interest rate across all fixed-rate mortgages, the change in median interest rate across all fixed-rate mortgages (2022–2023), and the median home sale prices for homes financed with 30-year and 15-year mortgages.

To improve relevance, only records with complete data were included in the analysis, and metro areas were grouped into the following cohorts based on population size:

- Small metros: less than 350,000

- Midsize metros: 350,000-999,999

- Large metros: 1,000,000 or more

References

- Board of Governors of the Federal Reserve System. (2024, May 1). Federal Reserve issues FOMC statement. Retrieved on May 6, 2024 from https://www.federalreserve.gov/newsevents/pressreleases/monetary20240501a.htm.

- Jonathan Jones. (2024, April 9). U.S. Cities Most Impacted by High Interest Rates. Construction Coverage. Retrieved on May 6, 2024 from https://constructioncoverage.com/research/cities-most-impacted-by-changing-interest-rates.

- Federal Financial Institutions Examination Council. (2024). Home Mortgage Disclosure Act [Data set]. Retrieved on May 6, 2024 from https://ffiec.cfpb.gov/.

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.